模型介绍

评分卡模型是一种常用于信用风险评估的模型,通常用于预测个体的违约概率或信用风险。

评分卡模型基于统计学和机器学习技术,通过将各种变量(如个人信息、财务信息等)转化为分数来评估个体的信用风险水平。

评分卡模型的基本原理是根据历史数据和违约情况建立一个预测模型,该模型可以根据个体的特征给出一个信用评分,该评分反映了个体发生违约的可能性。

数据集

GermanCredit数据集是一个经典的信用风险评估数据集,通常用于机器学习和数据分析的教学和实践。该数据集包含了德国银行客户的个人信息和信用情况,以及他们是否违约的标签信息。下面是该数据集的一些基本信息:

数据集包含1000个样本,每个样本有20个特征变量和1个目标变量。

特征变量包括客户的个人信息(如性别、年龄、婚姻状况)、财务信息(如贷款金额、贷款期限、存款金额)、工作信息等。

代码

library (scorecard)data ("germancredit" ):: skim (germancredit)

Data summary

Name

germancredit

Number of rows

1000

Number of columns

21

_______________________

Column type frequency:

character

1

factor

13

numeric

7

________________________

Group variables

None

Variable type: character

Variable type: factor

status.of.existing.checking.account

0

1

FALSE

4

no : 394, …: 274, 0 <: 269, …: 63

credit.history

0

1

FALSE

5

exi: 530, cri: 293, del: 88, all: 49

savings.account.and.bonds

0

1

FALSE

5

…: 603, unk: 183, 100: 103, 500: 63

present.employment.since

0

1

FALSE

5

1 <: 339, …: 253, 4 <: 174, …: 172

personal.status.and.sex

0

1

FALSE

4

mal: 548, fem: 310, mal: 92, mal: 50

other.debtors.or.guarantors

0

1

FALSE

3

non: 907, gua: 52, co-: 41

property

0

1

FALSE

4

car: 332, rea: 282, bui: 232, unk: 154

other.installment.plans

0

1

FALSE

3

non: 814, ban: 139, sto: 47

housing

0

1

FALSE

3

own: 713, ren: 179, for: 108

job

0

1

FALSE

4

ski: 630, uns: 200, man: 148, une: 22

telephone

0

1

FALSE

2

non: 596, yes: 404

foreign.worker

0

1

FALSE

2

yes: 963, no: 37

creditability

0

1

FALSE

2

goo: 700, bad: 300

Variable type: numeric

duration.in.month

0

1

20.90

12.06

4

12.0

18.0

24.00

72

▇▇▂▁▁

credit.amount

0

1

3271.26

2822.74

250

1365.5

2319.5

3972.25

18424

▇▂▁▁▁

installment.rate.in.percentage.of.disposable.income

0

1

2.97

1.12

1

2.0

3.0

4.00

4

▂▃▁▂▇

present.residence.since

0

1

2.85

1.10

1

2.0

3.0

4.00

4

▂▆▁▃▇

age.in.years

0

1

35.55

11.38

19

27.0

33.0

42.00

75

▇▆▃▁▁

number.of.existing.credits.at.this.bank

0

1

1.41

0.58

1

1.0

1.0

2.00

4

▇▅▁▁▁

number.of.people.being.liable.to.provide.maintenance.for

0

1

1.16

0.36

1

1.0

1.0

1.00

2

▇▁▁▁▂

数据清洗

代码

<- var_filter (germancredit, y = "creditability" , lims = list (missing_rate = 0.95 ,identical_rate = 0.95 , info_value = 0.02 var_rm = c ("installment.rate.in.percentage.of.disposable.income" ), var_kp = c ("duration.in.month" ,"credit.history" , "purpose" , "credit.amount" , "savings.account.and.bonds" , "job"

✔ 1 variables are removed via identical_rate

✔ 5 variables are removed via info_value

✔ Variable filtering on 1000 rows and 20 columns in 00:00:00

✔ 7 variables are removed in total

lims:是一个列表,包含了三个筛选条件:

missing_rate = 0.95:表示如果某个变量的缺失率超过95%,则将其删除。 i

dentical_rate = 0.95:表示如果某个变量的取值完全相同的比例超过95%,则将其删除。

info_value = 0.02:表示如果某个变量的信息价值(IV)低于0.02,说明该变量对目标变量的预测能力较弱,将其删除。

信息价值(Information Value,IV)是衡量一个特征变量对目标变量的预测能力的指标,通常用于评估变量在二分类问题中的重要性。信息价值的计算通常包括以下步骤:

计算每个特征变量的分箱(binning):将连续型变量离散化为若干个分箱,或者对离散型变量进行分组,以便后续计算IV。

对每个分箱计算如下指标:

正样本数量(Positive Count):该分箱中目标变量为正类别的样本数量。

负样本数量(Negative Count):该分箱中目标变量为负类别的样本数量。

正样本比例(Positive Rate):正样本数量占该分箱样本总数的比例。

负样本比例(Negative Rate):负样本数量占该分箱样本总数的比例。

计算每个分箱的证据权重(Weight of ,WOE):

WOE表示正样本比例与负样本比例的对数比值的自然对数。公式如下:

计算IV值:

IV表示该分箱中正负样本比例差异对模型预测的影响程度。公式如下:

IV值的设计有以下几个原因:

对数比值的转换:IV值的计算基于对数比值(WOE),这种转换可以将正负样本比例的差异转化为线性关系,更好地反映了特征变量对目标变量的影响程度。

区分度和稳定性:IV值不仅考虑了特征变量不同分箱中正负样本比例的差异,还通过对数比值的转换增强了区分度和稳定性。这样可以更准确地评估特征变量的预测能力。

简单直观:IV值的计算简单直观,通过对正负样本比例的差异进行加权求和,可以直观地反映特征变量在不同分箱中的影响程度,便于理解和解释。

可比性:IV值的范围固定在0到正无穷,不受样本量和特征变量取值范围的影响,使得不同特征变量的IV值具有可比性,可以用于特征选择和模型评估。

通常情况下,IV值的范围如下:

通过计算信息价值,可以帮助选择对目标变量预测能力较强的特征变量,从而提高模型的准确性和泛化能力。

划分数据

代码

<- split_df (dt_f, y = "creditability" , ratios = c (0.6 , 0.4 ), seed = 30 )<- lapply (dt_list, function (x) x$ creditability)

计算IV

WOE是通过比较每个分箱内正负样本的比例来计算的,它表示了特征变量在不同分箱中对目标变量的影响程度。

WOE用于评估特征变量在不同分箱内的预测能力,可以帮助选择合适的分箱方案。

IV则用于衡量特征变量整体对目标变量的预测能力,可以帮助筛选对模型预测能力有贡献的特征变量。

代码

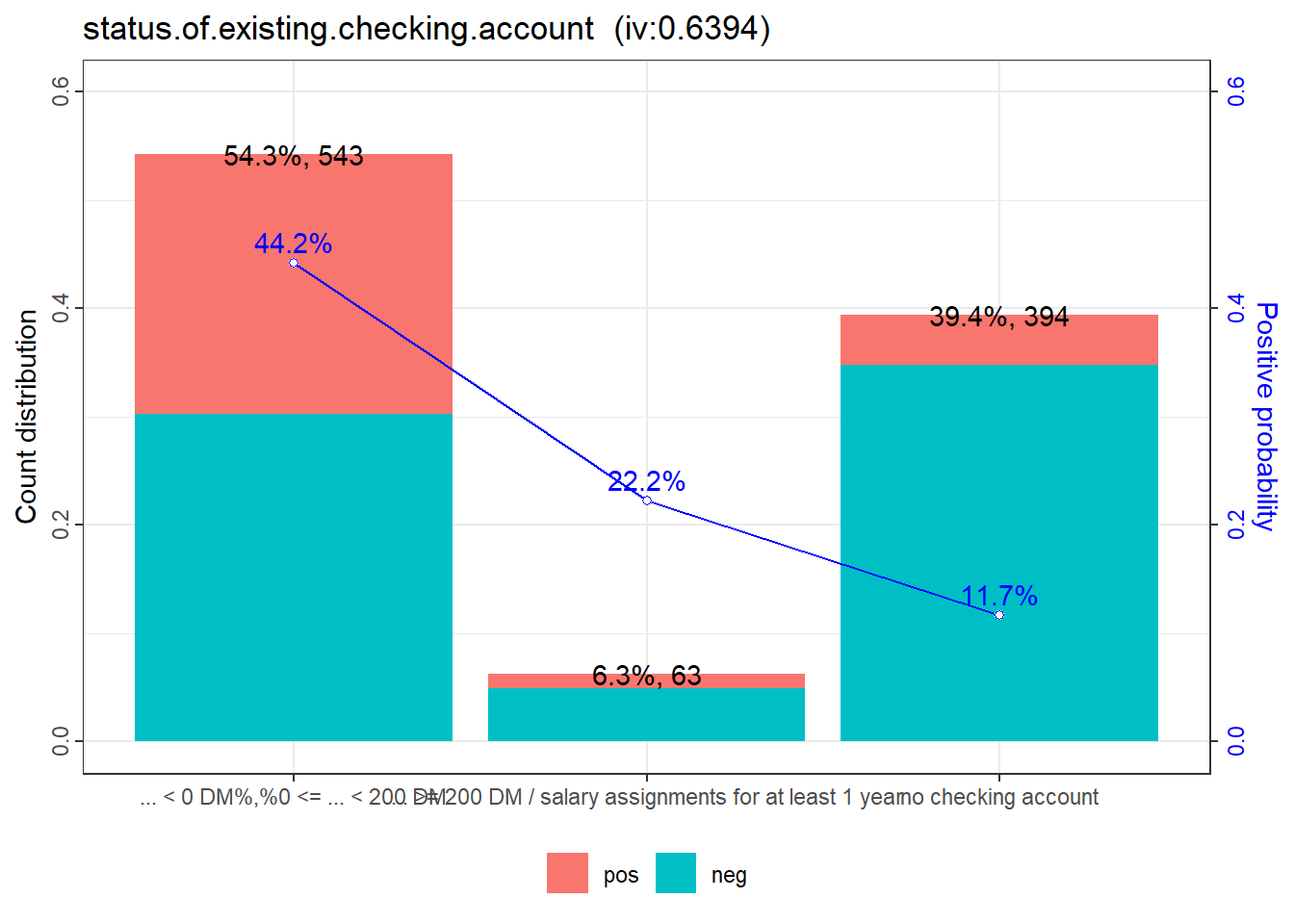

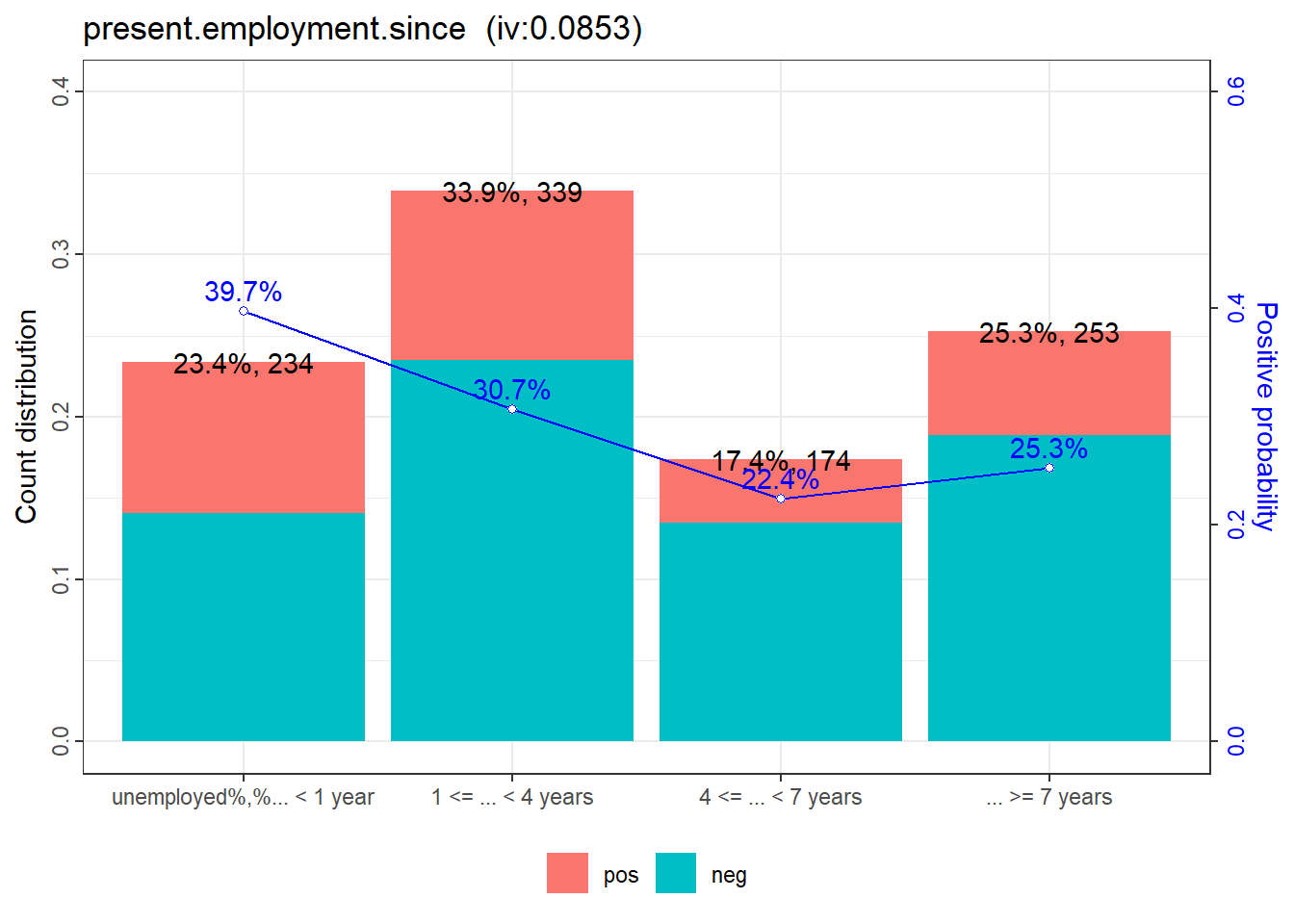

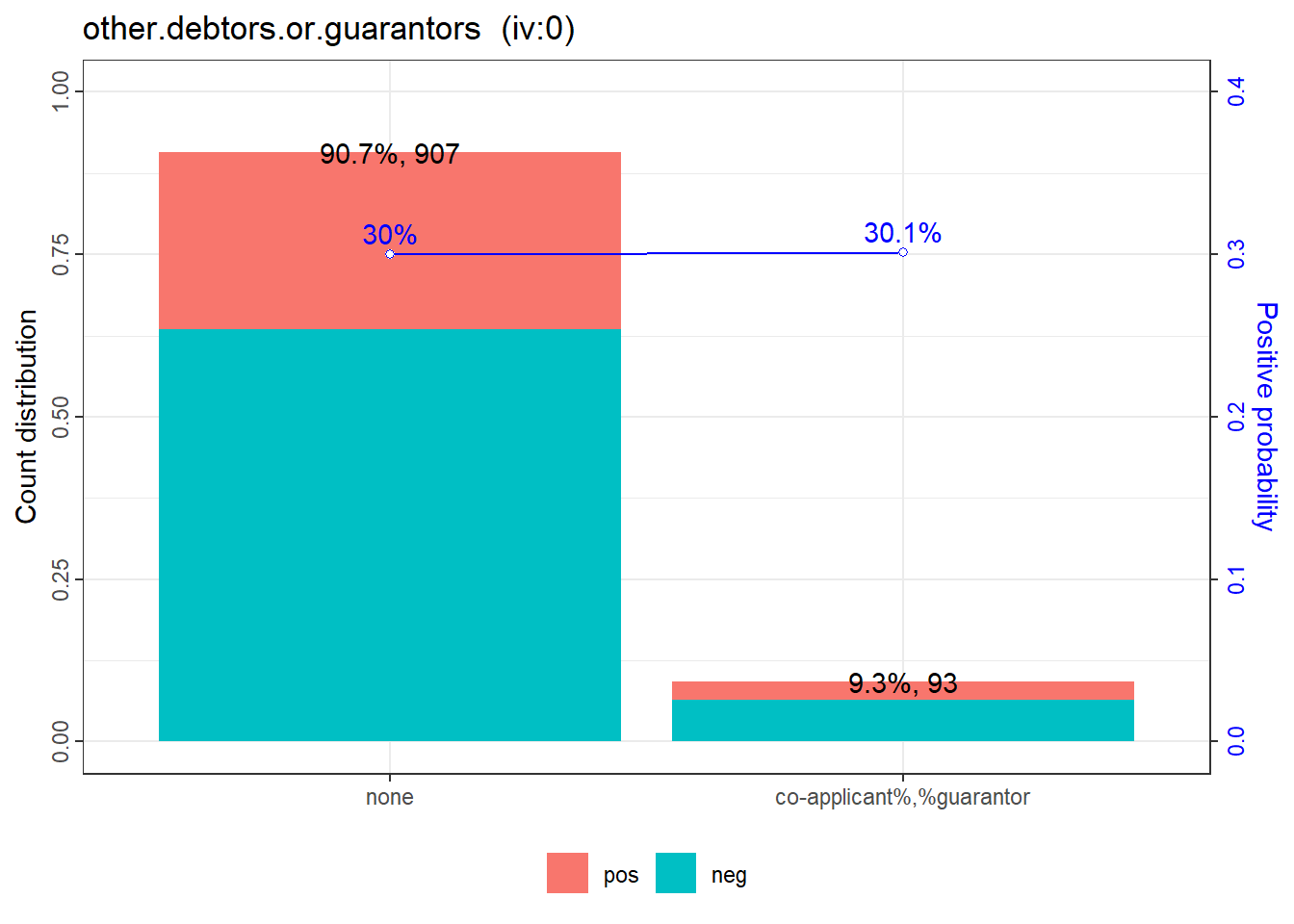

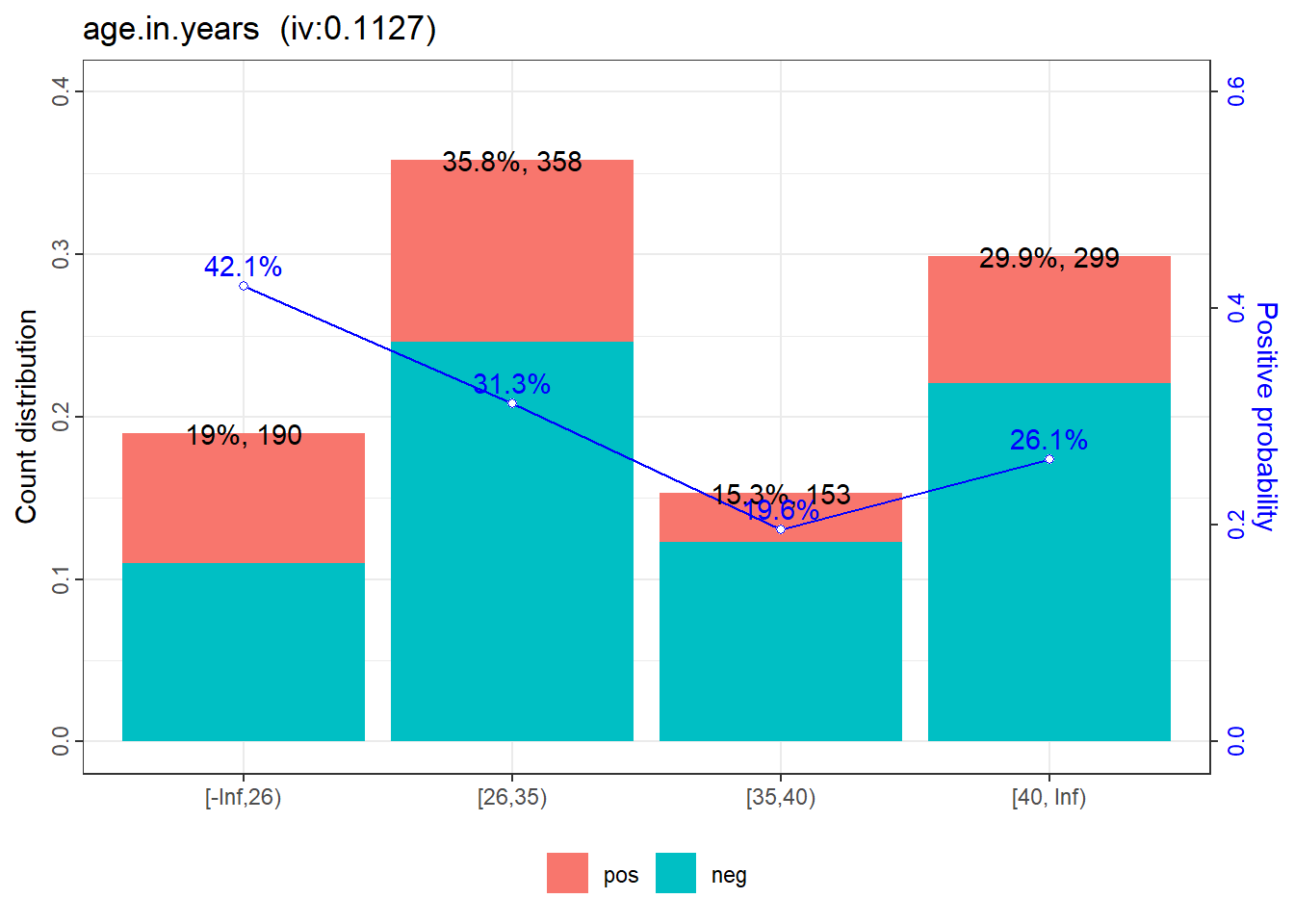

# bins <- woebin(dt_f, y = "creditability") ## 手动设置指定变量的划分,未手动设置的会自动计算划分分箱 <- list (age.in.years = c (26 , 35 , 40 ),other.debtors.or.guarantors = c ("none" , "co-applicant%,%guarantor" )<- woebin (dt_f, y = "creditability" , breaks_list = breaks_adj)<- woebin_plot (bins_adj)

✔ Binning on 1000 rows and 14 columns in 00:00:01

代码

for (p in woe_plot) {print (p)

代码

iv (dt_f, y = "creditability" )

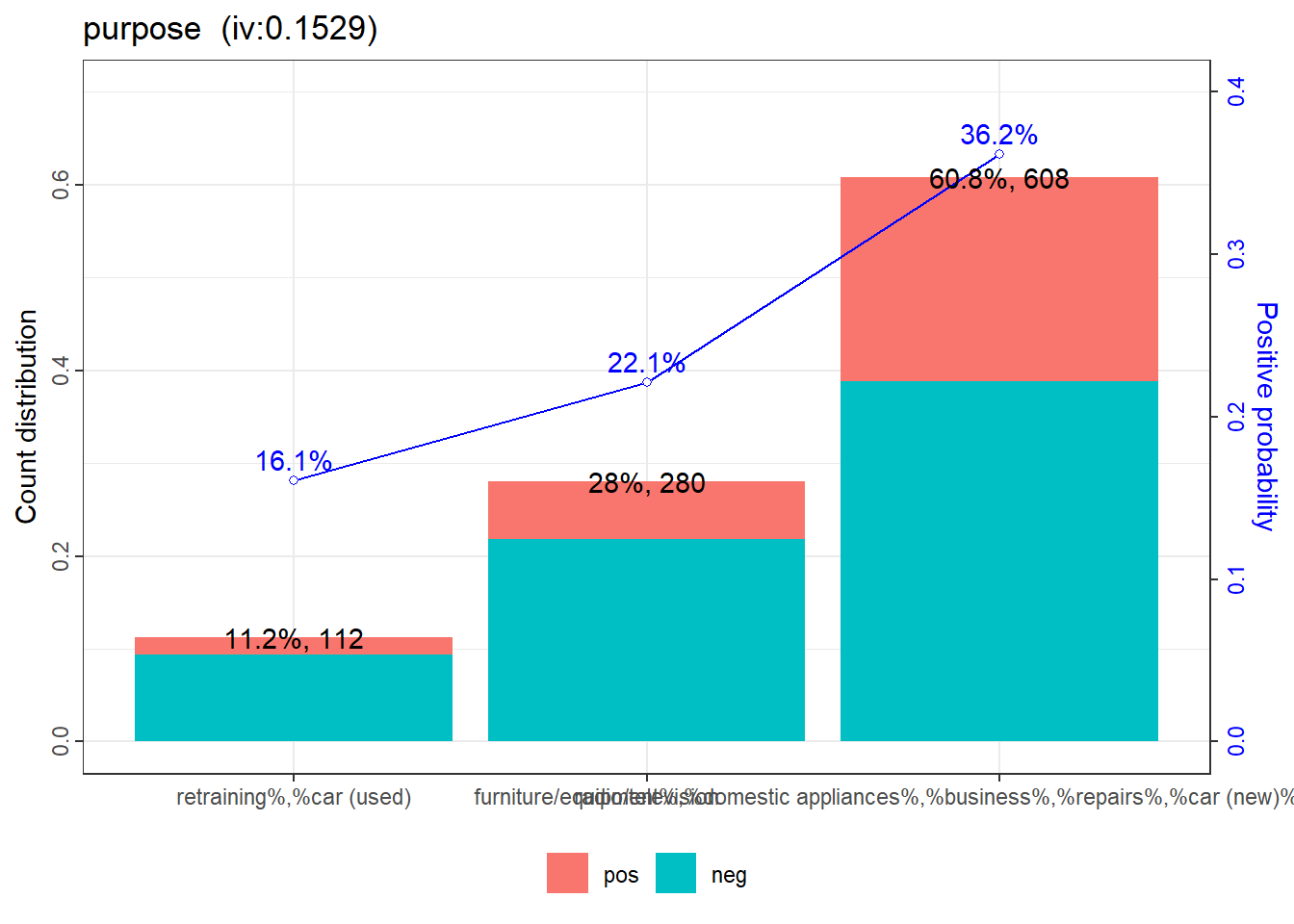

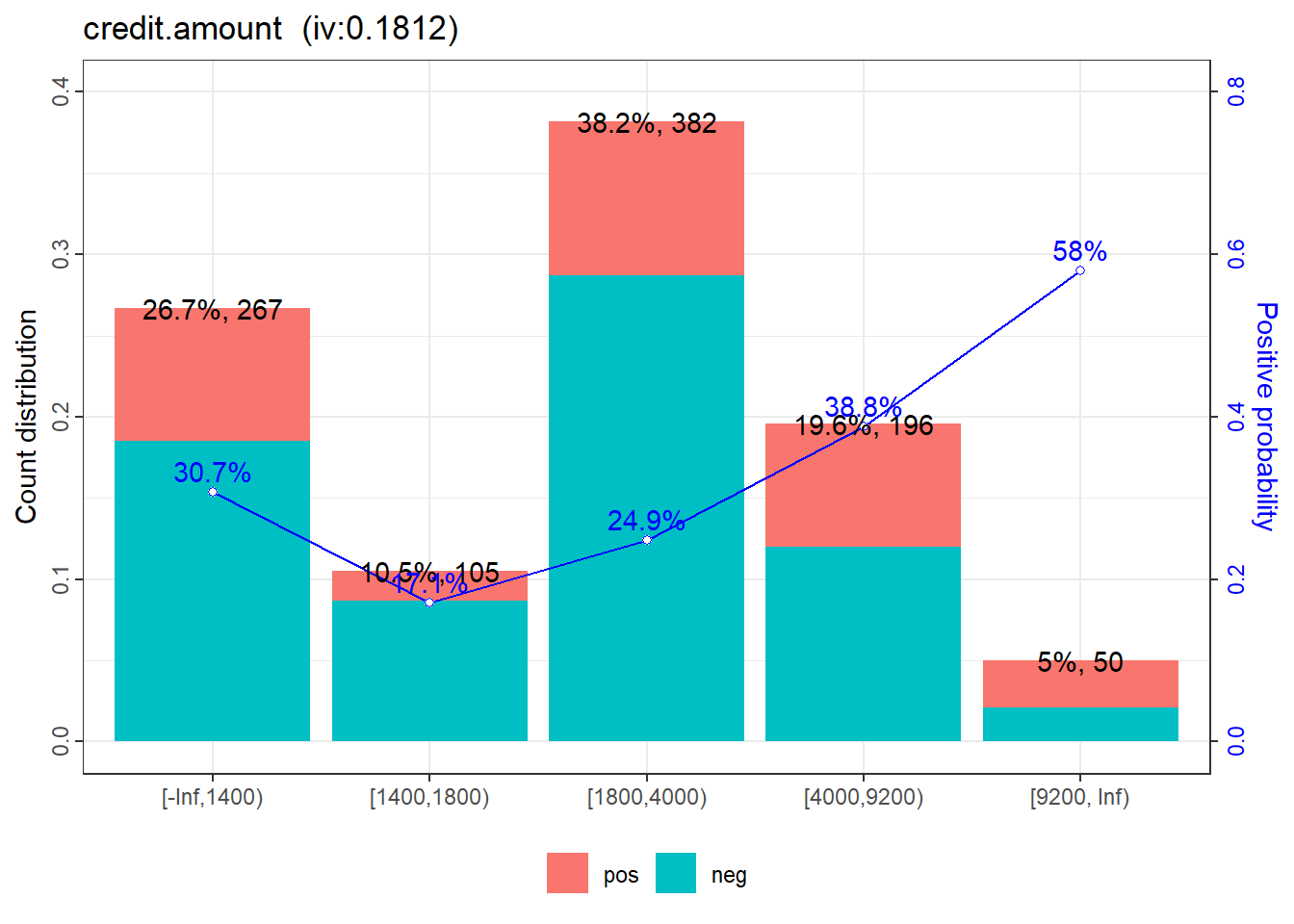

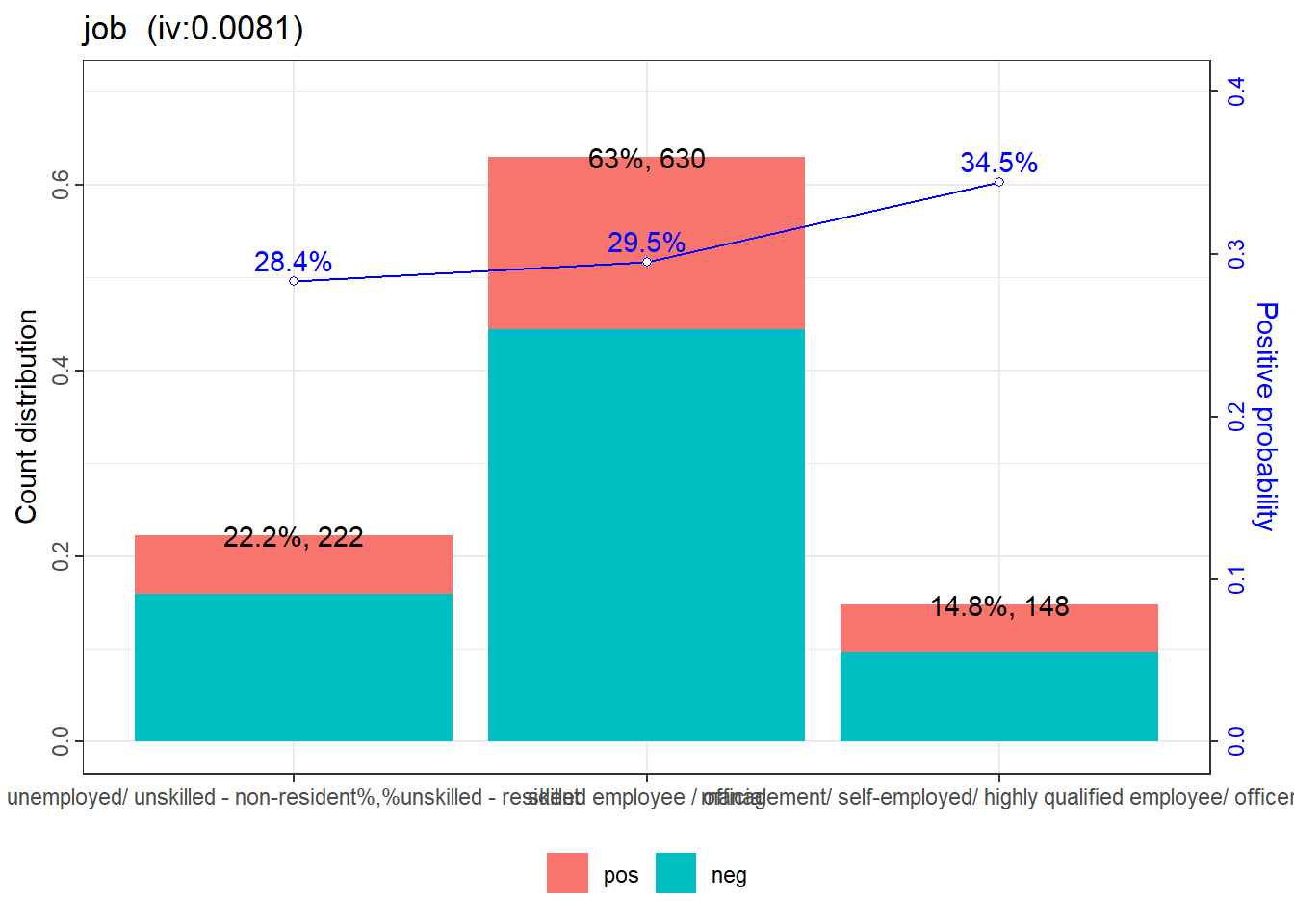

variable info_value

<char> <num>

1: status.of.existing.checking.account 0.666011503

2: duration.in.month 0.334503490

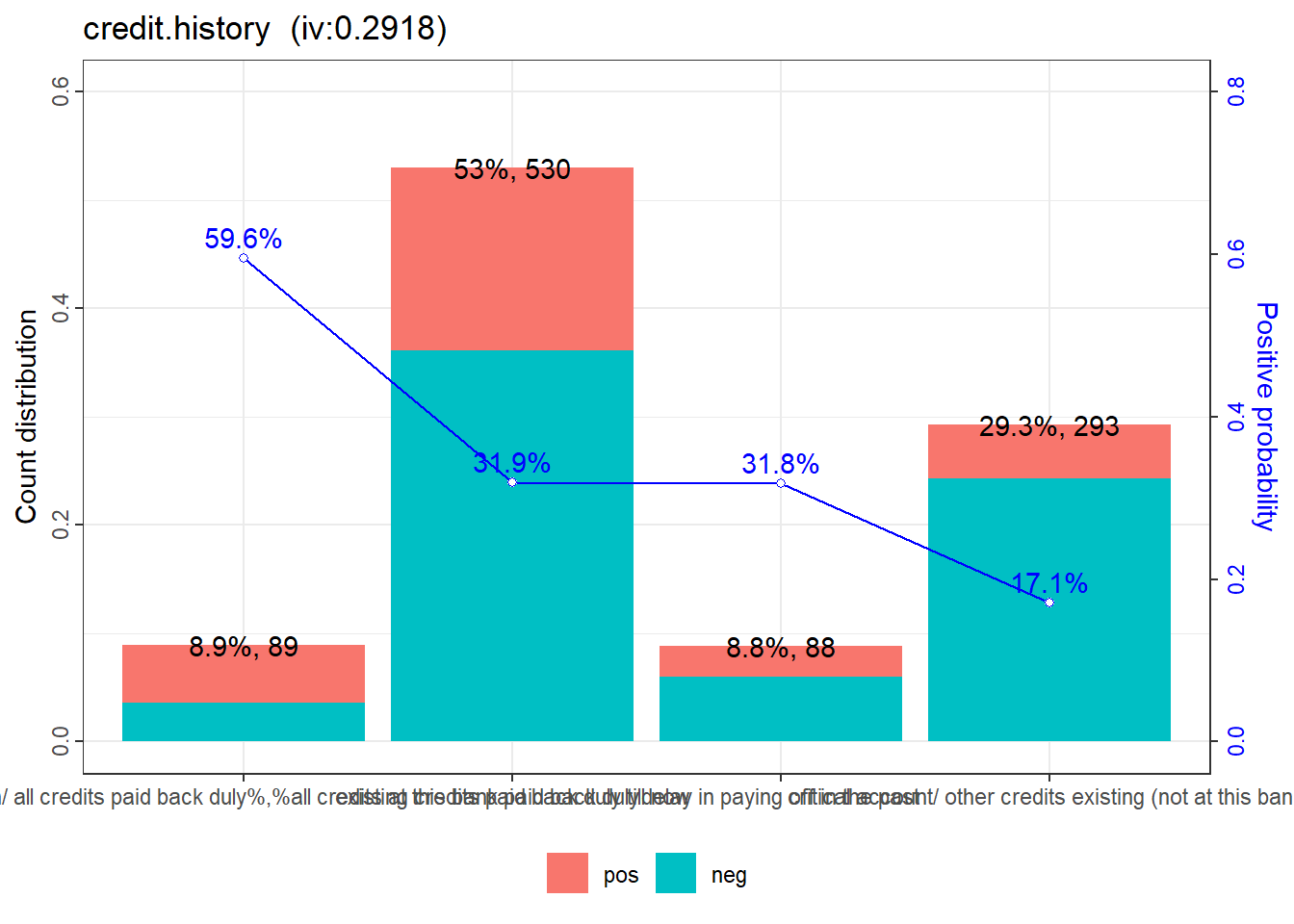

3: credit.history 0.293233547

4: age.in.years 0.259651423

5: savings.account.and.bonds 0.196009557

6: purpose 0.169195066

7: property 0.112638262

8: present.employment.since 0.086433631

9: housing 0.083293434

10: other.installment.plans 0.057614542

11: credit.amount 0.038957265

12: other.debtors.or.guarantors 0.032019322

13: job 0.008762766

根据IV值的排序,可以看出”status.of.existing.checking.account”对目标变量的预测能力最强,而”job”的预测能力最弱。

模型训练与评估

逻辑回归

代码

<- lapply (dt_list, function (x) woebin_ply (x, bins_adj))

✔ Woe transformating on 620 rows and 13 columns in 00:00:00

✔ Woe transformating on 380 rows and 13 columns in 00:00:00

代码

<- glm (creditability ~ ., family = binomial (), data = dt_woe_list$ train)vif (m1, merge_coef = TRUE )

variable Estimate Std. Error z value

<char> <num> <num> <num>

1: (Intercept) -0.9420468 0.1080 -8.7234

2: status.of.existing.checking.account_woe 0.7395712 0.1379 5.3638

3: present.employment.since_woe 0.4501553 0.3530 1.2753

4: other.debtors.or.guarantors_woe -59.0105980 62.5310 -0.9437

5: property_woe 0.3664055 0.3630 1.0093

6: age.in.years_woe 0.9479652 0.3264 2.9043

7: other.installment.plans_woe 0.8051799 0.4284 1.8795

8: housing_woe 0.6622283 0.3871 1.7109

9: duration.in.month_woe 0.7951651 0.2315 3.4351

10: credit.history_woe 0.7665071 0.2012 3.8095

11: purpose_woe 0.8399740 0.2730 3.0773

12: credit.amount_woe 0.6183492 0.2793 2.2137

13: savings.account.and.bonds_woe 0.7549808 0.2592 2.9125

14: job_woe -0.4809787 1.2026 -0.4000

Pr(>|z|) gvif

<num> <num>

1: 0.0000 NA

2: 0.0000 1.046089

3: 0.2022 1.059807

4: 0.3453 1.043887

5: 0.3128 1.413885

6: 0.0037 1.116636

7: 0.0602 1.066091

8: 0.0871 1.200516

9: 0.0006 1.259093

10: 0.0001 1.053644

11: 0.0021 1.055321

12: 0.0269 1.230359

13: 0.0036 1.047956

14: 0.6892 1.162128

代码

Call:

glm(formula = creditability ~ ., family = binomial(), data = dt_woe_list$train)

Coefficients:

Estimate Std. Error z value Pr(>|z|)

(Intercept) -0.9420 0.1080 -8.723 < 2e-16

status.of.existing.checking.account_woe 0.7396 0.1379 5.364 8.15e-08

present.employment.since_woe 0.4502 0.3530 1.275 0.202206

other.debtors.or.guarantors_woe -59.0106 62.5310 -0.944 0.345322

property_woe 0.3664 0.3630 1.009 0.312841

age.in.years_woe 0.9480 0.3264 2.904 0.003680

other.installment.plans_woe 0.8052 0.4284 1.879 0.060179

housing_woe 0.6622 0.3871 1.711 0.087099

duration.in.month_woe 0.7952 0.2315 3.435 0.000592

credit.history_woe 0.7665 0.2012 3.809 0.000139

purpose_woe 0.8400 0.2730 3.077 0.002089

credit.amount_woe 0.6183 0.2793 2.214 0.026851

savings.account.and.bonds_woe 0.7550 0.2592 2.912 0.003586

job_woe -0.4810 1.2026 -0.400 0.689186

(Intercept) ***

status.of.existing.checking.account_woe ***

present.employment.since_woe

other.debtors.or.guarantors_woe

property_woe

age.in.years_woe **

other.installment.plans_woe .

housing_woe .

duration.in.month_woe ***

credit.history_woe ***

purpose_woe **

credit.amount_woe *

savings.account.and.bonds_woe **

job_woe

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

(Dispersion parameter for binomial family taken to be 1)

Null deviance: 747.03 on 619 degrees of freedom

Residual deviance: 569.79 on 606 degrees of freedom

AIC: 597.79

Number of Fisher Scoring iterations: 5

逐步回归

代码

<- step (m1, direction = "both" , trace = FALSE )<- eval (m_step$ call)vif (m2, merge_coef = TRUE )

variable Estimate Std. Error z value

<char> <num> <num> <num>

1: (Intercept) -0.9431266 0.1074 -8.7774

2: status.of.existing.checking.account_woe 0.7362323 0.1359 5.4183

3: age.in.years_woe 0.9678239 0.3121 3.1012

4: other.installment.plans_woe 0.8091478 0.4250 1.9040

5: housing_woe 0.8011065 0.3580 2.2379

6: duration.in.month_woe 0.8175203 0.2242 3.6463

7: credit.history_woe 0.7836733 0.1998 3.9229

8: purpose_woe 0.8783576 0.2698 3.2562

9: credit.amount_woe 0.6433905 0.2742 2.3466

10: savings.account.and.bonds_woe 0.7198093 0.2548 2.8248

Pr(>|z|) gvif

<num> <num>

1: 0.0000 NA

2: 0.0000 1.024429

3: 0.0019 1.031024

4: 0.0569 1.054627

5: 0.0252 1.032548

6: 0.0003 1.189060

7: 0.0001 1.047566

8: 0.0011 1.032988

9: 0.0189 1.188081

10: 0.0047 1.023866

代码

Call:

glm(formula = creditability ~ status.of.existing.checking.account_woe +

age.in.years_woe + other.installment.plans_woe + housing_woe +

duration.in.month_woe + credit.history_woe + purpose_woe +

credit.amount_woe + savings.account.and.bonds_woe, family = binomial(),

data = dt_woe_list$train)

Coefficients:

Estimate Std. Error z value Pr(>|z|)

(Intercept) -0.9431 0.1074 -8.777 < 2e-16

status.of.existing.checking.account_woe 0.7362 0.1359 5.418 6.02e-08

age.in.years_woe 0.9678 0.3121 3.101 0.001927

other.installment.plans_woe 0.8091 0.4250 1.904 0.056906

housing_woe 0.8011 0.3580 2.238 0.025230

duration.in.month_woe 0.8175 0.2242 3.646 0.000266

credit.history_woe 0.7837 0.1998 3.923 8.75e-05

purpose_woe 0.8784 0.2698 3.256 0.001129

credit.amount_woe 0.6434 0.2742 2.347 0.018947

savings.account.and.bonds_woe 0.7198 0.2548 2.825 0.004731

(Intercept) ***

status.of.existing.checking.account_woe ***

age.in.years_woe **

other.installment.plans_woe .

housing_woe *

duration.in.month_woe ***

credit.history_woe ***

purpose_woe **

credit.amount_woe *

savings.account.and.bonds_woe **

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

(Dispersion parameter for binomial family taken to be 1)

Null deviance: 747.03 on 619 degrees of freedom

Residual deviance: 573.44 on 610 degrees of freedom

AIC: 593.44

Number of Fisher Scoring iterations: 5

解决样本不均衡问题

代码

# weights参数的作用是指定每个数据点(观测值)在拟合逻辑回归模型时所应具有的权重。权重可以用来调整每个数据点对模型拟合的贡献,从而解决样本不平衡(support.sas.com/kb/22/601.html) library (data.table)<- 0.03 # bad probability in population <- 0.3 # bad probability in sample dataset <- copy (dt_woe_list$ train)[, weight : = ifelse (creditability == 1 , p1 / r1, (1 - p1) / (1 - r1))][]<- as.formula (paste ("creditability ~" , paste (names (coef (m2))[- 1 ], collapse = "+" )))<- glm (fmla, family = binomial (), data = dt_woe, weights = weight)

模型评估

代码

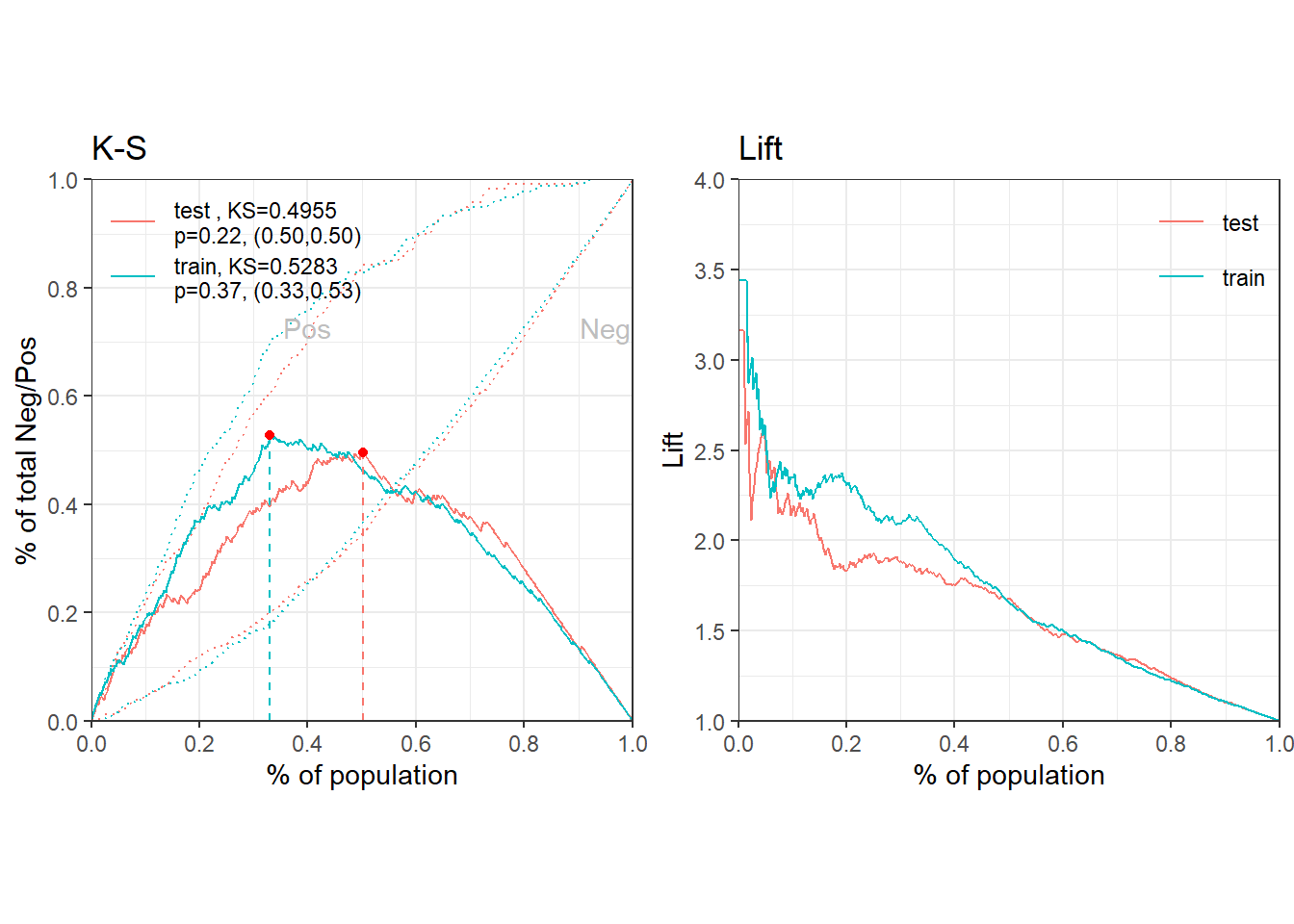

<- lapply (dt_woe_list, function (x) predict (m2, x, type = "response" ))<- perf_eva (pred = pred_list, label = label_list)

代码

$binomial_metric

$binomial_metric$train

MSE RMSE LogLoss R2 KS AUC Gini

<num> <num> <num> <num> <num> <num> <num>

1: 0.1520812 0.3899759 0.4624491 0.2618686 0.5282828 0.8180745 0.636149

$binomial_metric$test

MSE RMSE LogLoss R2 KS AUC Gini

<num> <num> <num> <num> <num> <num> <num>

1: 0.1695588 0.4117751 0.4990282 0.2152473 0.4955128 0.7998878 0.5997756

$pic

TableGrob (1 x 2) "arrange": 2 grobs

z cells name grob

1 1 (1-1,1-1) arrange gtable[layout]

2 2 (1-1,2-2) arrange gtable[layout]

创建评分卡

基于逻辑回归结果创建评分卡

代码

<- scorecard (bins_adj, m2,points0 = 600 , odds0 = 1 / 19 ,pdo = 50 , basepoints_eq0 = FALSE

$basepoints

variable bin woe points

<char> <lgcl> <lgcl> <num>

1: basepoints NA NA 456

$status.of.existing.checking.account

variable

<char>

1: status.of.existing.checking.account

2: status.of.existing.checking.account

3: status.of.existing.checking.account

bin count count_distr

<char> <int> <num>

1: ... < 0 DM%,%0 <= ... < 200 DM 543 0.543

2: ... >= 200 DM / salary assignments for at least 1 year 63 0.063

3: no checking account 394 0.394

neg pos posprob woe bin_iv total_iv

<int> <int> <num> <num> <num> <num>

1: 303 240 0.4419890 0.6142040 0.225500603 0.639372

2: 49 14 0.2222222 -0.4054651 0.009460853 0.639372

3: 348 46 0.1167513 -1.1762632 0.404410499 0.639372

breaks is_special_values

<char> <lgcl>

1: ... < 0 DM%,%0 <= ... < 200 DM FALSE

2: ... >= 200 DM / salary assignments for at least 1 year FALSE

3: no checking account FALSE

points

<num>

1: -33

2: 22

3: 62

$age.in.years

variable bin count count_distr neg pos posprob woe

<char> <char> <int> <num> <int> <int> <num> <num>

1: age.in.years [-Inf,26) 190 0.190 110 80 0.4210526 0.5288441

2: age.in.years [26,35) 358 0.358 246 112 0.3128492 0.0604652

3: age.in.years [35,40) 153 0.153 123 30 0.1960784 -0.5636891

4: age.in.years [40, Inf) 299 0.299 221 78 0.2608696 -0.1941560

bin_iv total_iv breaks is_special_values points

<num> <num> <char> <lgcl> <num>

1: 0.057921024 0.1127421 26 FALSE -37

2: 0.001324476 0.1127421 35 FALSE -4

3: 0.042679319 0.1127421 40 FALSE 39

4: 0.010817264 0.1127421 Inf FALSE 14

$other.installment.plans

variable bin count count_distr neg pos

<char> <char> <int> <num> <int> <int>

1: other.installment.plans bank%,%stores 186 0.186 110 76

2: other.installment.plans none 814 0.814 590 224

posprob woe bin_iv total_iv breaks is_special_values

<num> <num> <num> <num> <char> <lgcl>

1: 0.4086022 0.4775508 0.04593584 0.05759207 bank%,%stores FALSE

2: 0.2751843 -0.1211786 0.01165623 0.05759207 none FALSE

points

<num>

1: -28

2: 7

$housing

variable bin count count_distr neg pos posprob woe

<char> <char> <int> <num> <int> <int> <num> <num>

1: housing rent 179 0.179 109 70 0.3910615 0.4044452

2: housing own 713 0.713 527 186 0.2608696 -0.1941560

3: housing for free 108 0.108 64 44 0.4074074 0.4726044

bin_iv total_iv breaks is_special_values points

<num> <num> <char> <lgcl> <num>

1: 0.03139265 0.08329343 rent FALSE -23

2: 0.02579501 0.08329343 own FALSE 11

3: 0.02610577 0.08329343 for free FALSE -27

$duration.in.month

variable bin count count_distr neg pos posprob

<char> <char> <int> <num> <int> <int> <num>

1: duration.in.month [-Inf,8) 87 0.087 78 9 0.1034483

2: duration.in.month [8,16) 344 0.344 264 80 0.2325581

3: duration.in.month [16,34) 399 0.399 270 129 0.3233083

4: duration.in.month [34,44) 100 0.100 58 42 0.4200000

5: duration.in.month [44, Inf) 70 0.070 30 40 0.5714286

woe bin_iv total_iv breaks is_special_values points

<num> <num> <num> <char> <lgcl> <num>

1: -1.3121864 0.106849463 0.2826181 8 FALSE 77

2: -0.3466246 0.038293766 0.2826181 16 FALSE 20

3: 0.1086883 0.004813339 0.2826181 34 FALSE -6

4: 0.5245245 0.029972827 0.2826181 44 FALSE -31

5: 1.1349799 0.102688661 0.2826181 Inf FALSE -67

$credit.history

variable

<char>

1: credit.history

2: credit.history

3: credit.history

4: credit.history

bin

<char>

1: no credits taken/ all credits paid back duly%,%all credits at this bank paid back duly

2: existing credits paid back duly till now

3: delay in paying off in the past

4: critical account/ other credits existing (not at this bank)

count count_distr neg pos posprob woe bin_iv total_iv

<int> <num> <int> <int> <num> <num> <num> <num>

1: 89 0.089 36 53 0.5955056 1.23407084 0.1545526808 0.2918299

2: 530 0.530 361 169 0.3188679 0.08831862 0.0042056484 0.2918299

3: 88 0.088 60 28 0.3181818 0.08515781 0.0006488214 0.2918299

4: 293 0.293 243 50 0.1706485 -0.73374058 0.1324227042 0.2918299

breaks

<char>

1: no credits taken/ all credits paid back duly%,%all credits at this bank paid back duly

2: existing credits paid back duly till now

3: delay in paying off in the past

4: critical account/ other credits existing (not at this bank)

is_special_values points

<lgcl> <num>

1: FALSE -70

2: FALSE -5

3: FALSE -5

4: FALSE 41

$purpose

variable

<char>

1: purpose

2: purpose

3: purpose

bin

<char>

1: retraining%,%car (used)

2: radio/television

3: furniture/equipment%,%domestic appliances%,%business%,%repairs%,%car (new)%,%others%,%education

count count_distr neg pos posprob woe bin_iv total_iv

<int> <num> <int> <int> <num> <num> <num> <num>

1: 112 0.112 94 18 0.1607143 -0.8056252 0.05984644 0.1529244

2: 280 0.280 218 62 0.2214286 -0.4100628 0.04295896 0.1529244

3: 608 0.608 388 220 0.3618421 0.2799201 0.05011902 0.1529244

breaks

<char>

1: retraining%,%car (used)

2: radio/television

3: furniture/equipment%,%domestic appliances%,%business%,%repairs%,%car (new)%,%others%,%education

is_special_values points

<lgcl> <num>

1: FALSE 51

2: FALSE 26

3: FALSE -18

$credit.amount

variable bin count count_distr neg pos posprob

<char> <char> <int> <num> <int> <int> <num>

1: credit.amount [-Inf,1400) 267 0.267 185 82 0.3071161

2: credit.amount [1400,1800) 105 0.105 87 18 0.1714286

3: credit.amount [1800,4000) 382 0.382 287 95 0.2486911

4: credit.amount [4000,9200) 196 0.196 120 76 0.3877551

5: credit.amount [9200, Inf) 50 0.050 21 29 0.5800000

woe bin_iv total_iv breaks is_special_values points

<num> <num> <num> <char> <lgcl> <num>

1: 0.03366128 0.0003045545 0.1812204 1400 FALSE -2

2: -0.72823850 0.0468153322 0.1812204 1800 FALSE 34

3: -0.25830746 0.0241086966 0.1812204 4000 FALSE 12

4: 0.39053946 0.0319870413 0.1812204 9200 FALSE -18

5: 1.17007125 0.0780047502 0.1812204 Inf FALSE -54

$savings.account.and.bonds

variable

<char>

1: savings.account.and.bonds

2: savings.account.and.bonds

3: savings.account.and.bonds

bin count

<char> <int>

1: ... < 100 DM 603

2: 100 <= ... < 500 DM 103

3: 500 <= ... < 1000 DM%,%... >= 1000 DM%,%unknown/ no savings account 294

count_distr neg pos posprob woe bin_iv total_iv

<num> <int> <int> <num> <num> <num> <num>

1: 0.603 386 217 0.3598673 0.2713578 0.046647706 0.1909739

2: 0.103 69 34 0.3300971 0.1395519 0.002060052 0.1909739

3: 0.294 245 49 0.1666667 -0.7621401 0.142266143 0.1909739

breaks

<char>

1: ... < 100 DM

2: 100 <= ... < 500 DM

3: 500 <= ... < 1000 DM%,%... >= 1000 DM%,%unknown/ no savings account

is_special_values points

<lgcl> <num>

1: FALSE -14

2: FALSE -7

3: FALSE 40

代码

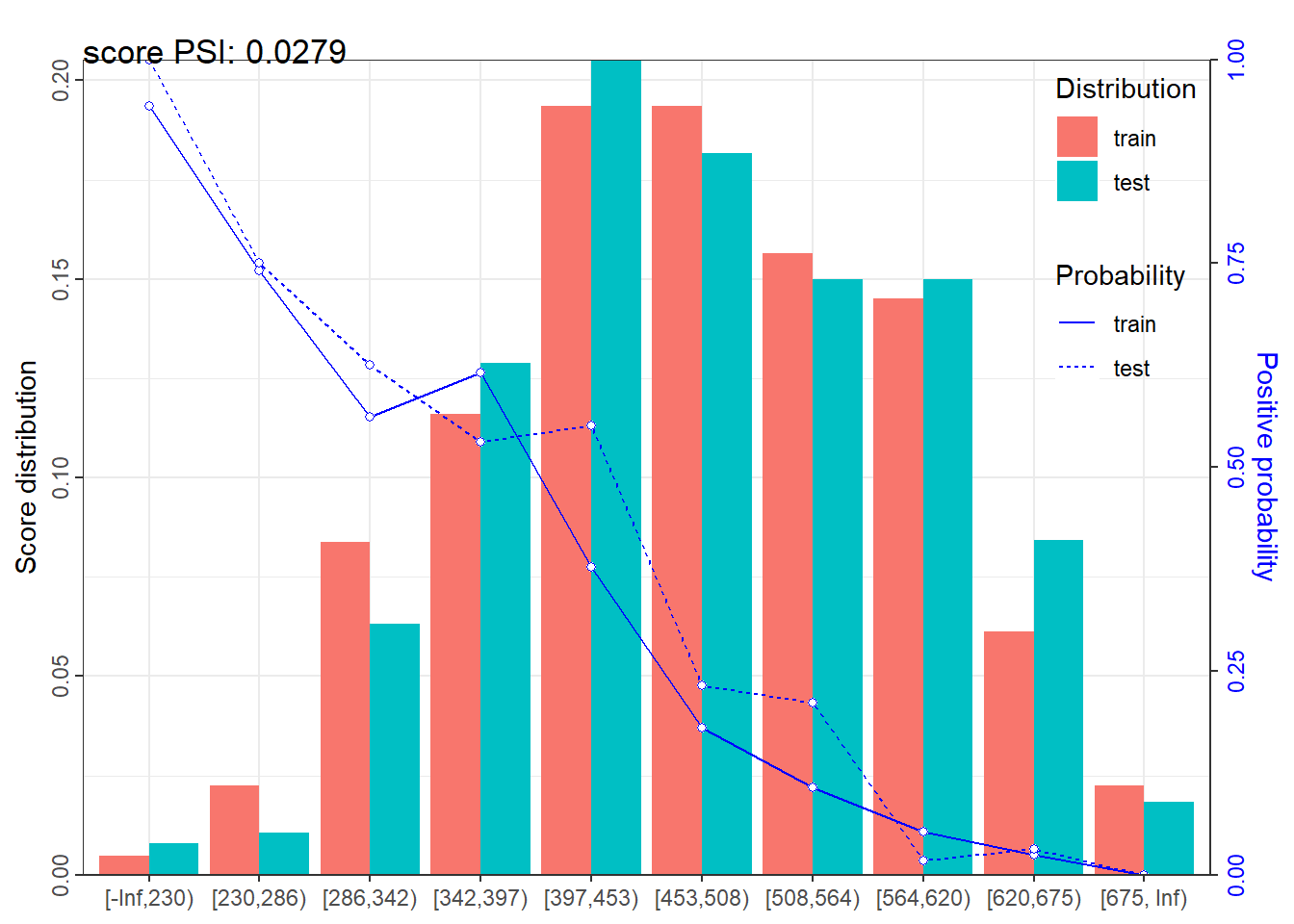

<- lapply (dt_list, function (x) scorecard_ply (x, card))perf_psi (score = score_list, label = label_list)

$psi

variable dataset psi

<char> <char> <num>

1: score train_test 0.02792477